Recurring billing: What is it and how does it work?

20 July 2023- 16 min read

20 July 2023- 16 min read

With the rising prominence of subscription-based business models, businesses must prioritize their chosen payment methods for customers. A business's success or failure often hinges on its payment strategy's effectiveness. Therefore, gaining a comprehensive understanding of recurring billing processing is essential.

In this article, we will delve into the significance of recurring billing and how it can play a pivotal role in determining the trajectory of your business. We will answer questions such as "What is recurring billing?" and "How does recurring billing work?". Join us as we explore the essentials of recurring billing and unlock the potential for your business's success.

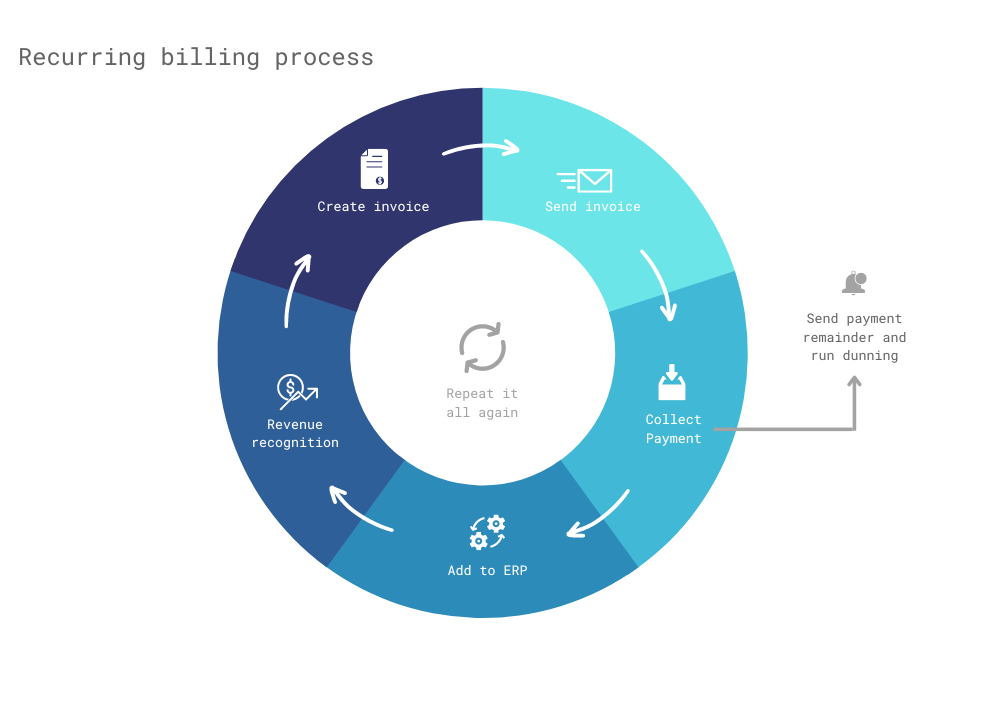

Recurring billing refers to the practice of subscription businesses regularly charging their customers for a product or service. The frequency of billing cycles can vary, with options including monthly, quarterly, or annually. In essence, it involves the systematic and precise billing of subscriptions to ensure accurate and timely payments from each customer. This process considers factors such as global taxes, proration, payment failures, and other considerations.

After a customer has subscribed to your product or service, recurring billing enables you to seamlessly process and accept regular payments. To ensure secure payment processing, payment gateways are utilized. Once the transaction is authorized and successfully processed, it can be directed to the accounting and reporting system to ensure precise revenue recognition.

Recurring billing software, such as Upodi, plays a vital role in streamlining this process by:

Automating the recurring billing process and eliminating manual errors.

Offer a personalized and devoted service to all customers.

Subscription-based services: This includes streaming platforms like Netflix or Spotify, subscription boxes, software-as-a-service (SaaS) products, and membership-based services.

Utilities: Recurring bills for electricity, water, gas, or internet services are typical examples of recurring billing.

Gym or fitness memberships: Many gyms or fitness centers charge their members regularly for access to their facilities and services.

Insurance premiums: Insurance companies often bill their customers periodically for premiums on auto insurance, home insurance, or health insurance policies.

Also check out: SaaS Recurring Billing

Subscription and recurring billing are often confused as they share many similarities. Both models involve an automated billing system, storage of customer payment information, and periodic withdrawal of funds from the customer's account. Additionally, both subscription billing and recurring billing can accommodate various payment methods.

The primary distinction between them lies in their pricing structures. Subscription businesses typically offer multiple pricing plans, allowing customers to switch between higher or lower plans according to their needs. On the other hand, recurring billing does not necessarily require different pricing tiers since the billing mechanism remains consistent across all plans.

It's important to note that while recurring billing is commonly associated with subscription businesses, it is suitable for any type of business, not limited to subscriptions.

Recurring billing can be classified into two main categories:

Fixed recurring billing encompasses collecting a consistent amount from the customer during each payment cycle. This approach is ideal for businesses that offer services at a fixed price, such as newspaper subscriptions or gym memberships.

Businesses can ensure a steady and uninterrupted revenue stream by employing fixed billing. Additionally, this method presents opportunities for upselling, allowing the business to offer additional products or services to customers and potentially increase its overall revenue.

Variable recurring billing involves collecting an amount from the customer that can vary in each payment cycle. This type of billing considers the customer's product usage or consumption, allowing for the creation of dynamic bills for each billing cycle. The fluctuating nature of variable recurring billing ensures customers are charged based on their actual usage or consumption, providing a more tailored and accurate billing experience.

Variable billing can be further categorized into two types: metered billing and quantity-based billing.

Metered billing, also known as usage-based billing, charges customers recurrently based on their service usage. It is commonly used by internet service providers and utility companies. Customers are typically billed for any usage beyond the base plan, providing flexibility and transparency in payment.

Quantity-based billing

Quantity-based billing charges customers based on an agreed-upon quantity at the time of purchase. It is commonly used by businesses like SaaS providers and volume-based cloud storage services. For example, SaaS providers charge based on the number of licenses or seats, while volume-based cloud storage services charge based on the storage space utilized.

Recurring billing is widely adopted due to its advantages for both customers and business owners.

Predictable revenue helps solve a lot of common business headaches. But it can only benefit you if you have established a reliable recurring billing engine.

When it comes to setting up a recurring billing system, there are three ways you can go:

What accounting software does well is - no surprise here - accounting. But what about subscription management, customer communication, and data concerns, among many other aspects of recurring billing?

When considering a DIY approach to handling your subscriptions and recurring billing, it may initially sound appealing. However, it's essential to recognize the significant amount of resources it demands, both in terms of finances and personnel. Additionally, you'll have the added responsibility of ensuring seamless integration with your ERP system and compliance with regulations like GDPR or PCI.

On the other hand, the true power lies within a dedicated recurring billing and subscription management platform. The term "dedicated" indicates that its primary objective is to address any challenges you may encounter with recurring billing. This includes automating invoicing, managing subscriptions, and providing various payment options. By utilizing such a platform, you can concentrate on refining your offerings and maximizing your profits.

Upodi is the Nordic leader in next-generation recurring billing and subscription management software. See how Upodi can help improve your recurring billing efforts; book a free trial!

Find out more about the author and follow them and social media to stay connected with them

Piper is our Head of Marketing. He is passionate about delivering business growth through media projects and marketing campaigns. Piper joined the team in February 2022.

Check out our related posts based on your search that you may like